Investor Experience Index: The Pre/Post Investment Communication Gap (Q1 2025)

In an analysis of limited partner reviews, a concerning pattern emerges in real estate sponsor-investor relationships: the notable disparity between pre and post-investment communication quality.

While most sponsors excel during the fundraising phase, averaging pre-investment communication scores above 3.0 even in otherwise poorly-rated investments, these scores drop dramatically after capital is committed. This "communication cliff" is most pronounced in poorly-rated investments, where post-investment communication scores plummet by up to 1.75 points on a 5-point scale.

The data reveals three distinct tiers of sponsor performance:

Elite Performers:

- Maintain consistent communication quality throughout the investment lifecycle

- Show minimal drop-off between pre and post-investment metrics

- Average 4.99 pre-investment and 4.97 post-investment scores

Middle Tier:

- Experience moderate communication decline post-investment

- Maintain acceptable but reduced engagement levels

- Show varied performance across metrics

Underperformers:

- Display the sharpest decline in communication quality

- Pre-investment scores average 3.15, dropping to 1.46 post-investment

- Often accompany misaligned expectations and leadership concerns

The Size Paradox

Further analysis reveals a counterintuitive relationship between sponsor size and investor satisfaction. Despite having greater resources for investor relations, the largest sponsors (>$1B AUM) show notably lower satisfaction rates, averaging 2.92 overall compared to 4.79 for mid-sized sponsors ($500M-1B).

This "size paradox" appears most pronounced in post-investment communication:

- $500M-1B sponsors: 4.77 pre-investment rises to 4.82 post-investment

- <$100M sponsors: Maintain consistent 5.00 ratings across both phases

- $1B AUM sponsors: 4.08 pre-investment drops to 3.17 post-investment

Mid-sized sponsors appear to hit a sweet spot, combining institutional-quality resources with maintained personal attention. This suggests that communication challenges may be more about scalability than resources, with larger organizations potentially struggling to maintain the personal touch that characterizes successful investor relations.

For LPs, this analysis underscores the importance of investigating a sponsor's long-term investor relations track record. High-touch fundraising communication, while common, may not translate to sustained engagement throughout the investment period. The data particularly suggests that size and resources alone don't guarantee better investor communication - and may actually predict the opposite.

Written by

Invest ClearlyInvest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

What Needs to “Die” in Passive Investing – According to Guests of The Invest Clearly Podcast

Get the answer to the closeout questions of each podcast episode: “What do you think needs to die in passive investing?” The answers are wide-ranging, from misconceptions about risk, to misleading marketing tactics, to structural issues in how deals are presented.

Passive Real Estate Investing Advice from Experienced LP Investors

Experienced LPs shared their most valuable lessons, drawn from years of investing across various asset classes and sponsor relationships.

LPs Have Been Slacking on Due Diligence—Here’s How to Step Up Your Game This Year.

Market volatility, rising interest rates, and unexpected shifts in asset performance have underscored the importance of thorough due diligence. For Limited Partners (LPs), the need to sharpen their evaluation strategies has never been greater. Whether assessing a new sponsor, evaluating a deal, or stress-testing an underwriting model, a refined due diligence approach can help mitigate risk and enhance returns.

What Is a Capital Stack?

Every real estate deal needs funding, which is why real estate syndication and private equity investments have become so widespread. However, where that money comes from and in what order it gets repaid isn't random. It's structured carefully, layer by layer, in what's known as the capital stack.

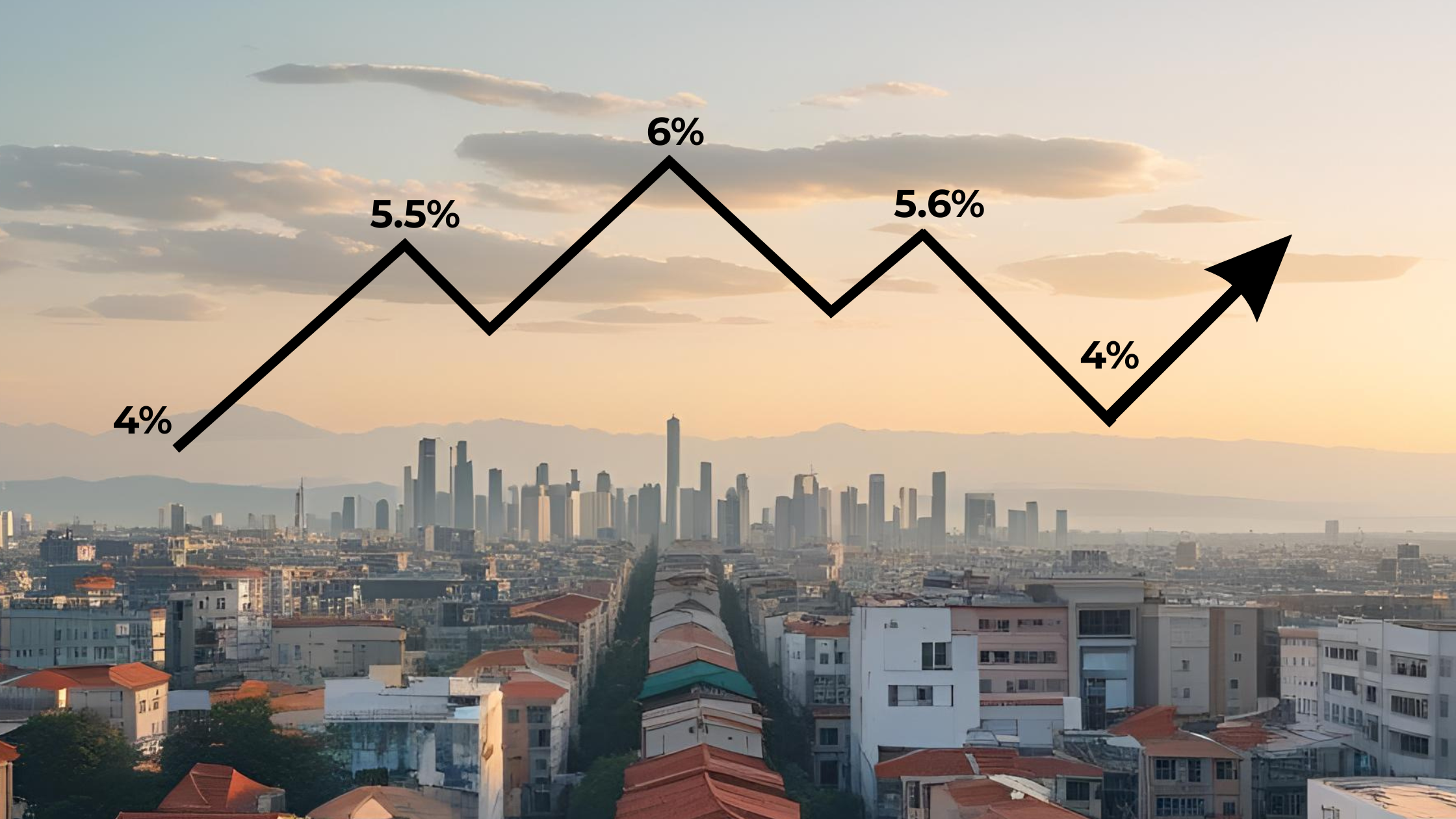

What is a Capitalization Rate in Real Estate

Learn about cap rates, how they are used in commercial real estate, and how investors should consider them when evaluating passive real estate investments.

Accumulation, Diversification, and Trust with Terra Padgett

Terra Padgett shares her approach to real estate investing. She reveals the framework she uses to manage a portfolio of over a dozen deals, moving from active single-family rentals to passive syndications.