Power of Community in Passive Investing | Brian Davis

Brian Davis, former landlord turned full-time LP and co-founder of SparkRental’s Co-Investing Club talks about what really matters when evaluating passive real estate deals.

Brian shares the mistakes that made him quit landlording for good, the red flags he watches for in sponsors, and why great property management can save a sinking deal. He also pulls back the curtain on how Spark’s 300+ members vet deals together and why dollar cost averaging isn't just for stocks — it's a powerful mindset for real estate investing, too.

This episode is packed with insights about passive investing, deal screening, operator due diligence, and why “conservative underwriting” is often just marketing fluff.

Invest Clearly Podcast - Episode 4 Podcast Transcript

Guest: Brian Davis, Spark Rental Co-Investing Club

[00:00:23] Pat: Investors and operators, welcome back to the Invest Clearly Podcast. My name is Pat Zella, and I'm your host and CEO of Invest Clearly. Today's episode, we sit down with Brian Davis, former landlord now full-time LP and co-founder of Spark Rentals Co-Investing Club. We talk about what he looks for in sponsors, why dollar cost averaging applies to real estate too, and how 50 sets of eyes can beat one when it comes to due diligence.

[00:00:42] Pat: He also breaks down the red flags he watches out for, how he evaluates property managers, and what really needs to die in passive investing. If you want to sharpen your LP instincts and hear how one investor is rethinking freedom and financial design, this one's for you.

[00:01:15] Pat: Brian, thank you very much for joining us. I'll hand it over to you for a quick introduction. Why don't we take a couple seconds to introduce yourself and we'll go from there.

[00:01:23] Brian: My name's Brian Davis. I've been in real estate investing for over 20 years. I fell into it by accident out of college, working for a hard money lender. My passion right now is organizing a club of other passive real estate investors to get together, vet deals together, and analyze risks together. We go in with smaller amounts than you'd have to otherwise. My partner and I did this because that's what we wanted for ourselves, for our own investments. In general, the best businesses come about because the founders see a need that they themselves need met. So they say, "We don't see anything else out there in the world that's doing that. Let's just create it ourselves." That's what we're doing right now.

[00:02:02] Pat: Is that full-time? Would you consider yourself a full-time passive investor?

[00:02:06] Brian: Well, the business Spark Rental as a business, I'm a full-time entrepreneur, running that business alongside my business partner and some employees that we have and some contracted workers. I do some freelance writing about investing, personal finance, and real estate, which started many years ago when we were trying to get Spark Rental off the ground to get it profitable and we ran out of money.

[00:02:27] Pat: You see a lot of almost clickbait posts about "achieve financial freedom through passive investing" or "retire off" passive investing. It seems like you are actually doing it—you're living the world beyond just making the investments. Would you agree with that? Is it like, "Hey, this actually set you up for the financial freedom life that some people are chasing"?

[00:02:51] Brian: I don't consider myself to be financially independent at this point. If we didn't have a daughter, we would probably—maybe I would consider myself financially independent. One of the things that has changed for me over the years: I used to be a pretty die-hard FIRE movement, FI kind of guy. I still believe in the basic tenets of that—having a high savings rate, building your net worth and your passive income as quickly as you can—but not so much anymore chasing that idea of "I'm going to go sip piña coladas on a beach for the rest of my life." That would get really boring and you would just become a fat alcoholic with a sunburn if that's how you spent the rest of your life.

[00:03:28] Brian: To me it's more about having work freedom—being able to do the kind of work that lights you up, makes you excited to get out of bed in the morning, even if you have an alarm going off. Of course if you have work freedom, you don't have to set an alarm necessarily. The idea of being able to pursue work that is meaningful to you, that's fulfilling, even if it doesn't pay a massive amount of money to you. That to me is the ultimate goal. And what should really replace that whole notion of FIRE and living on a beach. At the end of the day, you would just get bored doing nothing. Especially if you retire in your thirties, your forties, or even your fifties, the idea of going out and having control over the work that you do and doing work that really excites you—I think that really should be the goal.

[00:04:17] Brian: Yeah, build the net worth. Build the passive income streams. One of the things that I wrote about in our newsletter last week was this long weekend trip that my daughter and I took to the Amazon. We were able to pay for that entire trip with a fraction of our passive income for this month. That's the kind of stuff that's fun. But it's not really about sitting on a beach. It's about holistic lifestyle design.

[00:04:37] Pat: That's great. I would love to learn a little more about your portfolio, how you guys make decisions with investing. So with today's environment, are you guys still actively placing capital or are you in the wait-and-see mode?

[00:04:51] Brian: Oh yeah, no, we meet every month as an investment club and we vet a new deal, sometimes two deals in a month. That is part of our mission, that's part of what we do as a business—get together as an investment club. We vet these together and we try to put them through the wringer. It helps to have 50 sets of eyeballs on these at the same time, trying to poke holes in these deals.

[00:05:09] Brian: We're very much investing right now. Actually, I don't think that it's a bad time to invest. Now, let me preface that by saying that I am very much opposed to the very notion of timing the market. Every time that I've tried to get clever with my investments—whether that's timing the market or trying to pick the next hot stock or the next hot asset class, or the next hot market—I've just been totally bulldozed by life, totally smacked around. And even when I was right, I ended up being wrong somehow. For example, there was a big boom in marijuana stocks back, I don't know, 12, 13, 14 years ago. And I saw that coming, but I was too early in it.

[00:05:50] Brian: So I put all this money into pot stocks, as a 20-something thinking that I was going to be clever. And even though the thesis of that was right, I was too early. And all the companies that I invested in, they got knocked out before the big surge in those stocks. So even when you're right, you're usually wrong when it comes to your actual results and your investments. I got crushed on those investments, those stupid pot stock things that I did 15 years ago. So I don't try to time the market anymore. I think it's a fool's game. You have to be right twice with it—you have to be right at the entry point and right at the exit point. So I don't do that anymore.

[00:06:15] Brian: At this point, I practice dollar cost averaging with my stock investments and my real estate investments. And that is part of what we're trying to do in this club—small investments every single month, keep participating in the market. So in our club, the minimum investment is five grand. Collectively we'll be investing half a million bucks, 600, 700, 800 grand. But each person can invest five grand and that makes it way easier to practice that dollar cost averaging of putting some money in every month or every other month or every quarter or whatever it is that you can afford to do.

[00:06:53] Brian: That has worked out well, both for me personally and for the co-investing club in general. And by the way, I invest every month in these investments myself. This is very much something that my partner and I wanted to do for ourselves, for our own investments too.

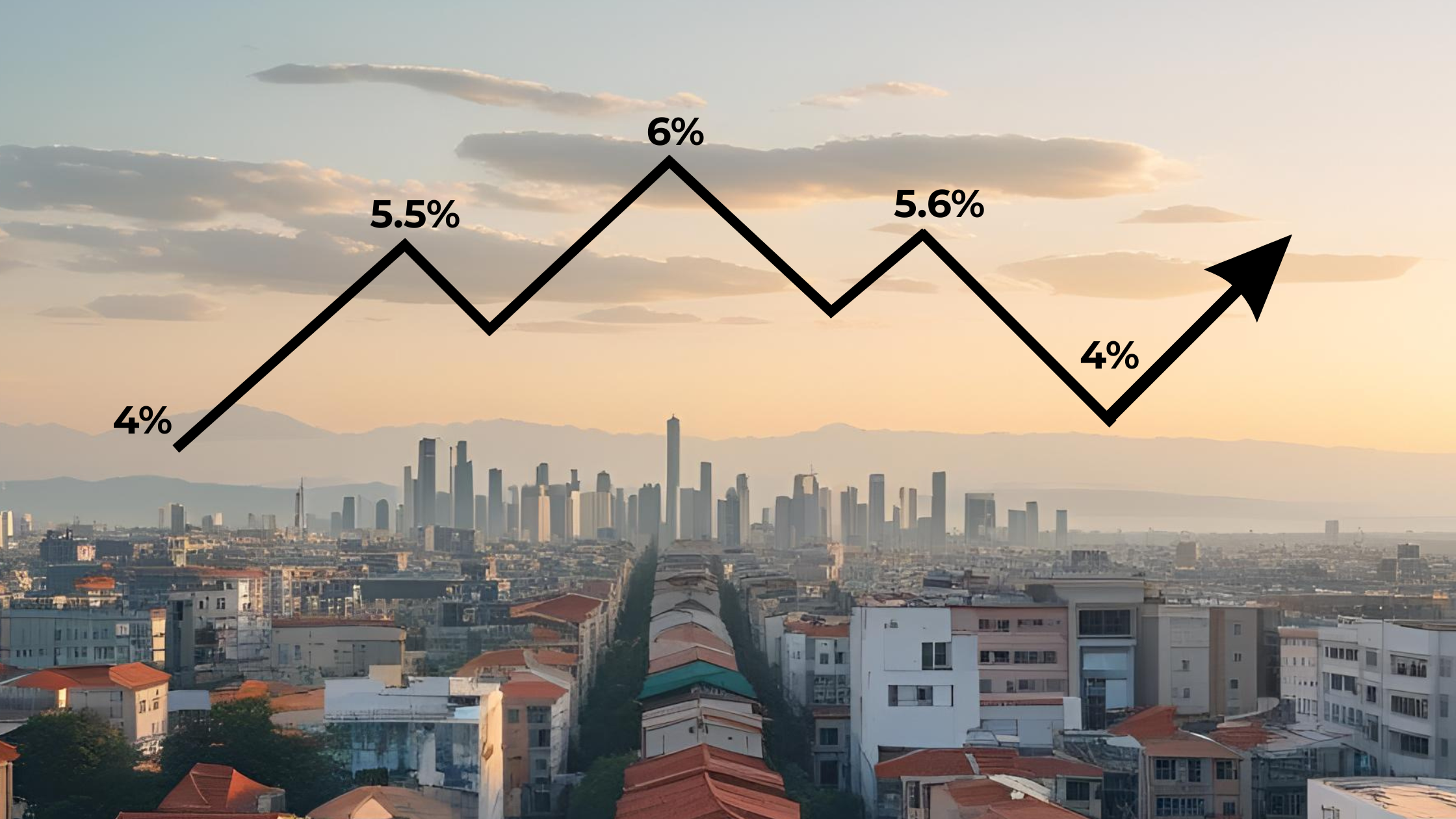

[00:07:08] Brian: Yeah, dollar cost averaging. I don't think it's a bad time to invest right now. It is a gloomy mood, especially in multi-family and in office space. But gloomy moods is usually the best time to buy in, as opposed to the euphoria when everyone's shooting off the party poppers, like in late 2021, early 2022, when multifamily and real estate syndications in general had just done great for the last few years. And that was a terrible time to invest, right? Interest rates were about to go through the roof. All these operators were about to get totally crushed on their variable interest debts and all that stuff.

[00:07:42] Brian: So the mood was great. It was actually a terrible time to invest. The mood is pretty sour right now and has been sour for a couple years. Maybe it's not such a bad time to invest. What's the saying? Invest when there's blood in the streets. Or buy when there's blood in the streets. Don't time the market. So throw everything I just said out the window.

[00:07:57] Pat: That's very cool. I'd love to learn a little bit more about the process of deal selection in Spark. One of the things that I've seen people really get caught up on over the last couple years—maybe a form of confirmation bias—as a deal comes in and you guys are underwriting it, how do you necessarily think about "oh, the majority is interested in this deal, so I'm going to go along with it" or "the majority thinks it's a bad deal"? I know you can't speak for everybody, but how do you individually think about that? Is it just "Hey, this is my process, I'm sticking to it. It doesn't matter what anybody else says, doesn't matter how full this deal gets," or is there some sort of "oh wow, what am I missing if everybody's interested in it and I'm not?"

[00:08:36] Brian: My partner and I select the deals each month for our co-investing club, and then what we'll do is we'll bring in the operator to come and give a quick summary of the deal and then open it up to Q&A and we all grill the operator together as a club. Then the operator will hop off the call and we'll have an internal club discussion about what we like about the deal, what we're concerned about with the deal—pros, cons, risks. My partner and I only pick deals that we want to put our personal money in. We will pre-vet these deals—even though legally we can't tell anyone that we're pre-vetting these deals, we do our own due diligence on these of course, before we decide to feature them in our co-investing club.

[00:09:16] Brian: These deals range—our club at this point is investing between roughly 400 and 850 grand a month in these deals. But I decide that I'm going to invest before we feature the deal. So for me personally, that decision's already been made. But it is really useful to hear other people's thoughts and reactions, to hear the questions that they throw at the operator. Inevitably there are some great questions that hadn't occurred to me, that our members are asking and that is part of the beauty of vetting these deals together as an investment club, as opposed to just going it alone. People are going to come up with really great questions, perspectives or extra data points that hadn't occurred to you.

[00:09:55] Brian: Sometimes that's geographical—we'll have a member say, "Hey, I live five minutes down the street from this building, pass it by on my commute every day and I can tell you X, Y, Z about this neighborhood or about this property or whatever." That's really useful. Or we'll have people with niche knowledge. We have a woman in our club who works in the insurance industry, so she's always picking apart the insurance quotes and especially the projected insurance increases in the performance stuff. So yeah, you get the hive mind, if you will. But as far as my partner's and my selection process, we want to look at risk from as many different angles as possible. We'll look at the debt structure, for example, and how much runway is there, is there some kind of rate protection in place, whatever that might be. Whether it's a rate swap or rate cap or a fixed interest rate or whatever it might be.

[00:10:40] Brian: We will look at things like property management risk—that's a big one. How many properties has this operator worked with the property manager on before?

[00:10:51] Pat: Background, right? You were in property—were you in property management in the past or were you an active...

[00:10:55] Brian: I was an active landlord and rental investor throughout my twenties and early thirties. So that is where my active investing background came in. I did flip a property or two, and I did a little bit of multifamily stuff, but it was mostly single family rental investing that I was doing. It turned out I hated being a landlord, which is why I'm not a landlord anymore and I only invest passively. But property management is super critical and my experience as a landlord did really reinforce that. I made every mistake in the book as a landlord and rental investor.

[00:11:29] Brian: I was buying in very low end neighborhoods and found that I couldn't get good property managers to manage these properties. That was a tough lesson where I bought these properties and figured, "I'll hand them off to a professional property manager and they'll do a great job for me." It turns out that really good professional property managers aren't going to take low end properties because they have three times the headaches and they bring in a third of the fees for the property manager. So why would they take them if they have a choice? So you're left with sort of the dregs, the bottom of the barrel for property management for those types of properties. I did learn a lot of those hard lessons along the way as an investor.

[00:12:01] Brian: Property management with syndication deals, for example: How many properties has this team, this property management team, worked with this operator on before in that market? If it's an operator who's going into a new market and they've never worked with the property manager before, that's a big red flag for us. If it's an operator who's done nine deals in that market, working with the exact same property management team, that's great. We love that stuff. I've seen this many times where bad property management can really sink an otherwise sound deal. And vice versa. I've seen really great property management keep a deal afloat that really has no business staying afloat. They managed to keep the occupancy high and they managed to keep the retention high and they managed to hold it together even though the deal had otherwise kind of fallen apart. I've seen that in deals. Property management—big.

[00:12:55] Brian: Same thing with the construction side. How many deals has that construction team worked on with this operator? Same concept there. These are the types of things we look at. Obviously experience is a big one. Track record. We want to get a sense for the market risk of the deal. How conservative is the underwriting? Every operator says that their underwriting is conservative, so you have to pick through and really put that to the test, and see how you feel about it. These are some of the things that we look at when we're looking at deals.

[00:13:22] Pat: How many deals would you say you are looking at to find one worth presenting? And then how many deals does everyone look at to find one worth investing in? What's that funnel look like for you roughly?

[00:13:36] Brian: We have deals constantly coming across our desk. That's part of the value that my partner and I are bringing to the club—we network with operators all the time. So we are constantly getting on the phone, meeting with new operators, meeting with operators who maybe we met with a year or two back, but we haven't talked to in a while, and just seeing how they're doing, what's going on with them and their properties. Obviously we get on their investor email lists. So these deals are just constantly flowing into our inbox. We have a little sub folder in our main inbox.

[00:14:06] Brian: When we're starting to look for the next month's deal, we'll go in there and we'll start picking through these deals and seeing which ones we like. If there's an operator who we haven't worked with in a while, but who we like a lot, maybe we'll reach out to them and say, "Hey, what's in your pipeline? What's coming up?" Sometimes one of the things that we do is we try to reach out to smaller operators who aren't necessarily syndicators, for example, and partner with them. So people who investors would not have found on their own necessarily. That is really important to us.

[00:14:38] Brian: We want to bring some kind of niche deals to our club that people aren't going to just find on their own or by banging around in BiggerPockets forums. And we love that stuff. We love doing little private partnerships with more mom and pop operators. So for example, we've partnered with a house-holding company that operates in Michigan. They're not syndicating deals. They're not really raising money from the public at large. But we got introduced to them by someone that we trust and we've done a few investments with them and partnered with them on some flips and that sort of thing. Same thing with a spec home developer in Texas. We've partnered with him on some development projects—land flippers, stuff like that.

[00:15:16] Speaker 2: This episode of the Invest Clearly Podcast is brought to you by Scale IR. If you are raising capital, you know the hardest part isn't just generating leads. It's turning those leads into committed investors. That's where Scale IR comes in. Scale IR transforms your investor engagement process with their proven solutions that optimize lead qualification, accelerate investor conversations, and drive higher conversions. From seamless CRM integration and intelligent workflows to expert investor qualification specialists who handle your initial discovery calls, Scale IR gives your team freedom to focus on closing deals. If you're ready to scale your investor relations and capital raising effectiveness, visit scaleir.com to learn more and book your strategy call today. Scale IR: engage smarter, convert faster.

[00:15:56] Pat: So when you think of the deals that are coming through, I recently had Layla Komoto on, and we were talking about the trends she's seeing now compared to maybe a year or two ago. And the big one was "Hey, deal flow seems to be down by a factor of three to four, but they're more conservative." But she's noticing cash flow is a lot tighter now. Are you noticing any trends with deals that are coming across your desk now versus a year, two, three ago?

[00:16:28] Brian: Well, there's definitely way fewer deals than three years ago. That's probably a good thing, right? To your point about the quality of deals has improved. As operators have tightened up their underwriting, the average operator has gotten more conservative with their underwriting, by necessity. That's good for the entire business. Again, that's one of the reasons why I feel like now is not such a terrible time to invest, despite the doom and gloom that you see in the headlines. I think operators are underwriting much better, much more conservatively now than they were even two years ago.

[00:16:56] Brian: As far as cashflow, we're still seeing some good cashflow deals. We do like cashflow deals in general in our club. We find that our members are reassured by those steady distributions and the higher yield and getting their hands on some of the returns in year one instead of having to wait five years before they see a cent. We do invest in growth deals as well. In general, we like the cash flow deals. You can see some of the glimmers of my past as a rental investor in some of that where I think it's easier to underwrite for, it's easier to project out cash flow than it is to project out profits from appreciation.

[00:17:30] Brian: Appreciation is somewhat speculative. Cash flow you can measure right now today. It's easier to project your operating expenses out over the next couple years and rent hikes out—that's all pretty easily projected. Where exit cap rate's going to be in five years from now, who can say, right? No one knows that. So as far as trends about what we're seeing today, definitely fewer deals. Better quality underwriting. There's that quote, I think it's Warren Buffett who said, "When the tide goes out, you can see who's been swimming naked."

[00:17:57] Brian: And we've definitely seen that—some of the operators who had just sterling reputations a few years ago, they're on our blacklist now. We won't invest with them. Go on Invest Clearly, for example, and actually check out these operators. I do think that the blood in the streets, if you will, has cleaned up the industry. It's knocked out some of the players who were playing a little too fast and loose. It's not a bad time to invest because of all those factors. But we're still seeing plenty of deals. There is no shortage of deals out there. We think that you can find very good quality deals right now if you do your due diligence.

[00:18:31] Pat: Sure. We talked heavy on "hey, how do you underwrite deals? What does that process look like?" One thing we really focus on at Invest Clearly is the operator. What has the experience actually been beyond some of the marketed or targeted returns? How do you think about not just the horse, but the jockey as well?

[00:18:50] Brian: I do think that there is a lot of truth in that saying in the industry that "bet on the jockey, not the horse." So we underwrite operators first and foremost, before we'll look at a single one of their deals. Vetting operators, first and foremost we want to get a sense for their experience level. There are operators who I know personally, people who I'm friends with and have a personal relationship with—they've come to me with deals and said, "Hey, I'm doing this deal." And the deal itself might look great, but if they've only done a couple syndication deals, even though I like and trust them as a person, they just don't have enough experience for me to feel comfortable bringing those deals in front of the 300 and some members in our co-investing club—us kind of putting our stamp of approval, if you will, on it. Attaching our name to it. Not as a co-sponsor—we don't co-sponsor deals—but just in general.

[00:19:38] Brian: We generally want to see someone who's done at least five syndication deals and other real estate deals before they started syndicating, whether that's smaller multifamilies that they bought by themselves or with JVs with other people. So yeah, we want to see a solid track record of experience. Ideally some deals that have gone full cycle, although that's not a prerequisite for us to consider somebody. We're actually doing a bonus deal right now in our club with an operator who's done nine deals total, and a bunch more before they got into syndication with partners. None of those nine deals have gone full cycle. But those deals are performing well. They're cash flowing well, they're ahead of projections. So we feel perfectly comfortable investing with them. The other one that we did earlier this month actually was with an operator who has done 145 syndication deals. And dozens of those have gone full cycle. It's nice to work with people with that much experience under their belt.

[00:20:27] Brian: So experience, trustworthiness is a big one and that's a lot harder to quantify than experience. So sometimes it takes a few conversations with operators and letting those conversations freewheel a little bit, and trying to let them meander and see where they go. Obviously we ask a lot of targeted questions, but we also want to just have a flowing conversation and get a sense for them as a person. How they treat their investor's money versus their own interests. That's a harder thing, but no less important for that. We want to see people who put their investor's interests ahead of their own. We always ask operators about "tell us about deals that have gone badly for you."

[00:21:11] Brian: Tell us what went wrong, how did you handle it? How did you communicate that to your investors? One of the things that we do is we go on platforms like Invest Clearly, like Passive Pockets, and we will look at independently verified reviews from LPs for these deals. We want to see what other LPs are saying about these deals. Often we'll ask the operator to connect us with LPs who have invested with them on multiple deals and hop on a quick phone call with them and just get a sense for how it's been for them—not just how the deals have performed, but how has the operator communicated? How do you feel about the way they're managing these properties? And again, just trying to connect as many data points as you can, both qualitative and quantitative, to paint that full picture about the operator.

[00:21:55] Pat: When you ask the question, "tell me about a deal that may have gone poorly," do you feel you get honesty, or do you often feel like it's like the interview question, "tell me your greatest weakness" that you spin into a positive message? How do you feel about that? And is that even a bad thing that they do that, or is it an honest answer of, "hey, this was the result"?

[00:22:17] Brian: Well, every operator has made mistakes and has had deals go awry on them in some way, shape, or form. If they haven't, then they don't have enough experience, right? And then we don't want to invest with them anyway because they haven't done enough deals. So no, I actually think it's a really telling question or rather their answer to that question is pretty telling. And that is how you can help separate out investors who you do versus don't want to invest with. I think answers to that question will say, "Hey, this thing happened that we weren't prepared for and that we didn't properly vet for and that's a mistake that we made once and now we vet for that. This is what we had to—we had to suspend distributions for three quarters or whatever it was. We had to exit that deal at a slight loss, but we were able to give all of our investors their full money back and we took that hit."

[00:23:07] Brian: That is a pretty good answer to that question. But to your point, sometimes people will have an overly polished answer to that question that makes me nervous and makes me hesitant to invest with them.

[00:23:19] Pat: Yeah. Understood. All right, Brian, I'd like to learn a little bit more about Spark. Tell us about the process to join. I saw you don't have to be accredited to join. I'd love to learn more about actually getting involved, the process and things like that.

[00:23:33] Brian: It's super simple. We are a flat fee membership business. It's $59 a month or $497 a year to be a member in the co-investing club. We will vet a deal together every month. We'll host a meeting and sometimes two deals a month. But one is what we're promising. We also get together for a separate educational call every month as well. Often we'll bring in an outside topic expert to speak about things like tax strategies for passive real estate investing or something like that. But yeah, we'll form a joint LLC for each deal. Any members who want to invest in that month's deal can do so with $5,000 or more, and they get listed as an owner in that joint LLC proportionate to what they invest. My partner and I do not get any kind of cut of the investment amount. We don't get an extra split or anything like that. We are not a fund of funds. We are not co-sponsoring deals. All the returns pass straight through to the joint LLC.

[00:24:29] Brian: I invest personally in every deal, so far I've been able to invest in every single deal. I'm one more member of the co-investing club. We set up a joint bank account for these LLCs and everybody gets access to that joint bank account—view access, no one can go in and raid the account. But everyone gets access to view the bank account and see every transaction. People can see as distributions come into the joint bank account. They can see when the big wire goes out to the operator and they can see every transaction. So full transparency. Everyone gets access as basically a joint venture partner. And then the LLC forms a single LP in that deal.

[00:24:58] Brian: For the operator, they get to work with one entity, one LP, they can send one K-1 and send one email update to us. And we just forward out those email updates to all of our members who participated in that deal. And when we get a K-1 for the joint LLC, our accounting team will divvy that up and send individual K-1s out to each person. Cost money—we just share those as a joint LLC, it's $75 per year for members in that LLC.

[00:25:36] Pat: Super interested. Thanks for sharing that. All right. I have one more question for you before we wrap up. What is one thing in passive investing that you think needs to die?

[00:25:47] Brian: One thing in passive investing that needs to die—novices or people who are first getting into it have a lot of preconceptions that I think are wrong and they're going to get them into trouble. One of those is a lot of people who get into passive real estate investing, they come from being an active real estate investor. Maybe buying rental properties like I used to, and they have this notion carry over from that that your investment's not going to go to zero. Maybe you could lose a little bit of money, you're not going to get the same returns, but it's not going to go to zero. You're not going to lose everything. That's not true. You can absolutely lose 100% of your investment in a passive investment because you're part of that common equity at the very top of the stack, right? A property doesn't have to drop to $0 in value for you to lose 100% of your investment capital.

[00:26:33] Brian: If common equity makes up 15% of the ownership of a property and that property drops by 15%, guess what? You've lost everything. So that's one misconception that needs to die for novice passive investors. The other, just industry-wide: there are too many operators who are in this for themselves. They're in it to get rich themselves and to make money rather than to make their investors rich. So it's one of the things that we look at when we're vetting deals and vetting operators is how do they structure their fees? When do they get paid? How do they get paid? And do we as LPs feel like our interests are being put ahead of theirs in the investment or the return breakdown structure?

[00:27:19] Pat: That's fantastic. All right, Brian, thank you so much. Where can people find more about you and Spark?

[00:27:25] Brian: SparkRental.com. And you can check us out on all the social platforms at Spark Rental. You'll see our co-investing club, front and center on our website. This is a niche thing that is great for some people, but maybe not for most people. So come join the club, attend a few meetings, see how it works, see how the deals work, see how you like them. And if it's not feeling—if it's not for you, if you're not feeling it—drop out with a full refund.

[00:27:49] Pat: Fantastic. Brian, thank you so much.

[00:27:51] Brian: Pat, this was a lot of fun. Thank you so much for having me.

[00:27:54] Pat: Absolutely.

[00:27:55] Speaker 4: Thanks for listening to the Invest Clearly Podcast. To find verified investor reviews or to claim your GP profile, please visit investclearly.com. If you enjoyed this episode, please remember to like, subscribe, and leave a review because that's how other people find this show. Till next time, invest clearly.

Written by

Invest ClearlyInvest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

What Needs to “Die” in Passive Investing – According to Guests of The Invest Clearly Podcast

Get the answer to the closeout questions of each podcast episode: “What do you think needs to die in passive investing?” The answers are wide-ranging, from misconceptions about risk, to misleading marketing tactics, to structural issues in how deals are presented.

Passive Real Estate Investing Advice from Experienced LP Investors

Experienced LPs shared their most valuable lessons, drawn from years of investing across various asset classes and sponsor relationships.

LPs Have Been Slacking on Due Diligence—Here’s How to Step Up Your Game This Year.

Market volatility, rising interest rates, and unexpected shifts in asset performance have underscored the importance of thorough due diligence. For Limited Partners (LPs), the need to sharpen their evaluation strategies has never been greater. Whether assessing a new sponsor, evaluating a deal, or stress-testing an underwriting model, a refined due diligence approach can help mitigate risk and enhance returns.

What Is a Capital Stack?

Every real estate deal needs funding, which is why real estate syndication and private equity investments have become so widespread. However, where that money comes from and in what order it gets repaid isn't random. It's structured carefully, layer by layer, in what's known as the capital stack.

What is a Capitalization Rate in Real Estate

Learn about cap rates, how they are used in commercial real estate, and how investors should consider them when evaluating passive real estate investments.

Accumulation, Diversification, and Trust with Terra Padgett

Terra Padgett shares her approach to real estate investing. She reveals the framework she uses to manage a portfolio of over a dozen deals, moving from active single-family rentals to passive syndications.